Bachelor in Banking and Finance (Hons) with a specialism in Financial Technology

Bachelor Degree

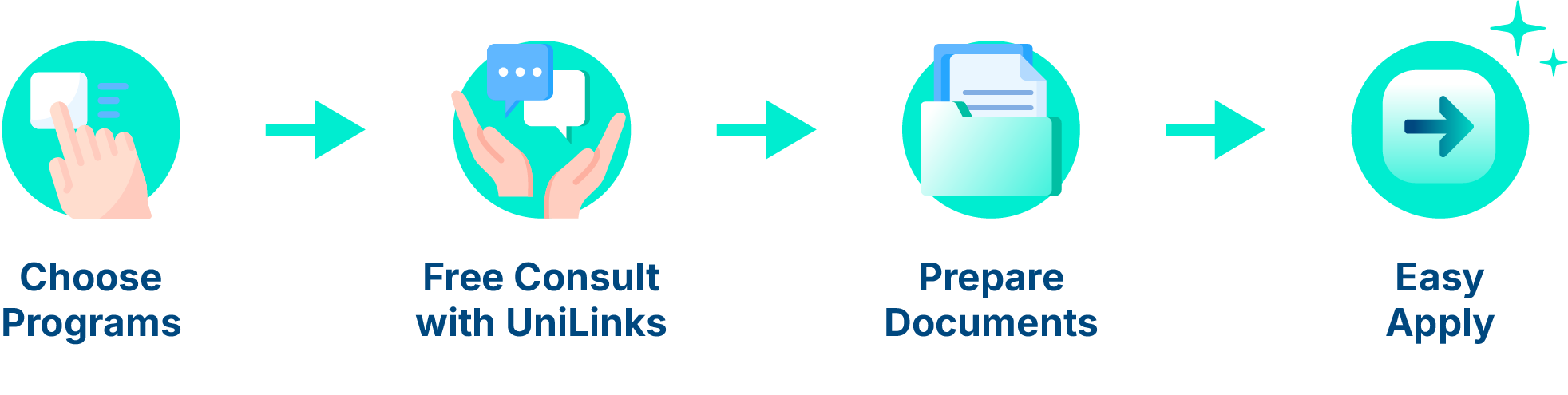

Free consultation for this program

We are ready to help you with your difficulties and processing.

Duration

3 years

Study Format

On Campus

No. of Student Mentors

73

Total Tuition Fees

24,330 USD (Approx)

Free consultation for this program

We are ready to help you with your difficulties and processing.

Duration

3 years

Study Format

On Campus

No. of Student Mentors

73

Total Tuition Fees

24,330 USD (Approx)

Program

Key information

University

Program structure

Tuition fees

Admissions

Possible Career Pathway

Student's testimonials

F&Qs

ABOUT THIS PROGRAM

What We Teach

This programme is specifically designed to provide students with:

- Knowledge and skills in handling financial products, product development and working within the rapidly changing Global Banking and Finance Industry.

- Opportunities to develop into highly competent managers, who are well qualified not only in Banking and Finance but also other professional areas required for successful business administration and management.

- Basic technical competency and professionalism on the technology that will transform the delivery of financial services.

- FinTech knowledge and technical skill relevant to Banking and Finance.

KEY INFORMATION

Degree

Bachelor

Language

English

Location

Malaysia

Intake Start Date

Mar 2026

Study Format

On Campus

Duration

3 years

Program Highlight

Dual Degree

Total Semester

9

Total Tuition Fees

24,330 USD (Approx) / in total

Application deadline

May 2026

ABOUT UNIVERSITY

Asia Ranking 2026

EduRank Ranking 597

Programs

125

Students

14,000

Asia Pacific University (APU) continues to solidify its reputation for graduate employability, achieving a remarkable 100% employment rate among its graduates. In recognition of its excellence, APU was named the 2025 Employers’ Choice of University in Talentbank’s annual national survey of top employers. Furthermore, APU graduates earned a prestigious 6-Star rating in the Employers' Top Choice categories for Computing & IT, Animation, Advertising, Finance, and Marketing.

APU also maintained its leading position as the Champion in the Computing & IT category nationwide. In the previous year, 2024, APU graduates were similarly recognized as Champions in Employers’ Top Choice for Computing & IT, Game Design and Development, Animation, and Finance & Islamic Finance - a testament to APU’s sustained excellence and industry relevance across multiple disciplines

APU is honoured to receive the Future-Ready University & College award in the private universities category at the LIFE AT WORK Awards 2025, organised by Talent Corporation Malaysia (TalentCorp).

This award recognises a Higher Educational Institution that goes beyond academic excellence to actively prepare their students for the realities of a dynamic, fast-changing workforce. This institution demonstrates a strong commitment to bridging the gap between education and career readiness.

This recognition reflects APU’s commitment to nurturing a future-ready generation through an inclusive, innovative, and supportive environment that prepares both students and staff to succeed in the evolving digital landscape.

See more

PROGRAM STRUCTURE

Degree Level 1

Students will learn fundamental skills required by every banking and finance professional, and the basic understanding of business management and finance. We will also expose them towards business & communication skills, accounting skills and management skills

Common Modules

- Quantitative Skills

- Introduction to Management

- Business and Communication Skills

- Financial Accounting 1

- Business Economics

- Financial System

- Financial Accounting 2

- Essential of Banking & Finance

- Business Law

- Marketing

Degree Level 2

A broader range of skills will be learnt, in which students will gain a better understanding of banking instruments, procedures, regulatory framework as well as overall financial system environment. Students will be introduced to hands-on training on the underlying technologies enabling FinTech solutions. They will also be exposed to the new FinTech solutions namely digital currencies, peer to peer lending and etc. In addition, they will also familiarise themselves with the fundamentals of data mining techniques. We will further nurture their independent learning to prepare them for the workplace and for further researches.

Common Modules

- Financial Statement Analysis

- Financial Technology

- Banking Instruments & Procedures

- Financial Planning

- Python for Financial Applications

- Law of Banking and Finance

- Financial Econometrics

- Business Research Methods

- Financial Management

- Applications of AI in Finance

Specialised Modules

- Digital Currencies and Blockchain Technologies

- Crowdfunding and Alternative Lending

Internship (16 Weeks)

Students will undertake an Internship/Industrial Training for a minimum period of 16 weeks to prepare them for a smooth transition from the classroom to the working environment.

Degree Level 3

Students will make use of their previous studies and industrial experience to learn about the governance, risk management, and compliance of financial technology and theories as well as the globalisation of banking and finance in Global Banking and Finance. Concept of empirical application of Robo Advisor and Entrepreneurial Finance will also be a target to groom them as a leader in financial technology. A final year project requires them to explore a topic individually - they will demonstrate their academic and practical aspects of their ability in the chosen area of study.

Common Modules

- Risk Management in Banking and Finance

- Financial Derivatives

- Corporate Finance

- Global Banking and Finance

- Investigations in Banking and Finance

- Ethics in Finance

- Final Year Project

Specialised Modules

- Entrepreneurial Finance

- Robo Advisor

- FinTech Risk Management and Regulations

- Portfolio Management

MQA Compulsory Subjects*

- Appreciation of Ethics and Civilisation (M’sian Students)

- Malay Communication Language (Int’l Students)

- Philosophy and Current Issues

- Workplace Professional Skills

- Integrity and Anti-corruption

- Co-Curriculum

(*All students are required to successfully complete these modules as stipulated by the Malaysian Qualification Agency.)

TUITION FEES

Tuition fees

24,330 USD (Approx) / in total

Application fees

3,350 MYR

Application fee cannot be refunded.

Get a Free Consultation!

Not sure where to start with your application?

Our student ambassadors can walk you through the admission process, step by step.

ADMISSIONS PROCESS

Admission Requirements

General Requirements

Direct Entry to Level 1 of the Degree

- STPM2 Passes in STPM with a minimum Grade C+ (GP 2.33) and a Credit in Mathematics and a Pass in English at SPM Level or its equivalent.

- A-Level2 Passes (Grade A-D) in A-Level in any 2 subjects, and a Credit in Mathematics and a Pass in English at SPM/O-Level/ IGCSE or its equivalent.

- UEC5 Grade B's in any subjects in UEC including Mathematics with a Pass in English.

- Matriculation/ FoundationPassed Foundation programme (minimum CGPA of 2.5) with a Credit in Mathematics and a Pass in English at SPM/O-Level/IGCSE or equivalent.

Entry to Level 2 of the Accounting, Banking or Finance Degree:

- Diploma in AccountingPassed Diploma with minimum CGPA of 2.5 and a Credit in Mathematics at SPM/O-Level/IGCSE level.

English Requirements

- International StudentsIELTS : 6.0

- TOEFL IBT : 60

- Pearson (PTE) : 59

- MUET : Band 4

Possible Career Pathway

Your Career Path

Entrepreneur

FinTech Specialist

Banking Specialist

Payment System Specialist

Data Analyst

Financial Analyst

Product Developer

Compliance Expert

FinTech Quantitative Developer

Strategy Analyst

Business Development Associate

Data Scientist (Finserv)

STUDENT's TESTIMONIALS

No testimonials available just yet — stay tuned!

FAQs

Not provided yet